1003 URLA - Lender

More Resources on the URLA Support Page

This feature was introduced with Encompass 19.3. (View the release notes)

This topic describes the process for completing the Lender portion of the redesigned Uniform Residential Loan Application (URLA) form that is required for all new loan applications in November 2020. For information about the pre-2020 version of the URLA, refer to 1003 Loan Application - Page 1, 1003 Loan Application - Page 2, 1003 Loan Application - Page 3, or 1003 Loan Application - Page 4.

The 1003 URLA – Lender input form is used by loan officers, administrators, and underwriters. Much of the content on the input form flows in from other input forms, calculations, or templates.

To Be Completed By Lender

Use the To be completed by the Lender section at the top of the form to enter the Agency Case No. and Lender Case No. for the loan, and to configure the loan identifier to use on the output form if this hasn’t already been configured on the 1003 URLA Part 1 or by using business rules or templates. You can also select a Loan Program for the loan and select the Include Lender Information Pages in Borrower Package checkbox to include the Lender Information pages when generating the All Pages URLA 2020 output form from the Print menu, in an eDisclosure package, or in a Closing docs package for all borrowers.

Case Numbers

The Agency Case No and Lender Loan Number (or ULI) print at the top of the URLA 2020 output forms. These behave in the same manner as the current (URLA 2009) application, so all current templates and settings will work in the same manner between the URLA 2009 and URLA 2020 form versions.

Include Lender Information Pages in Borrower Package

With URLA 2020 input forms, much of the data that is not directly relevant to the borrower or information that borrowers are able to provide themselves has been moved to the 1003 URLA – Lender input form. With the new URLA, lenders have the discretion to include or exclude that information when generating the All Pages versions of the URLA 2020 output form. Select the Include Lender Information Pages in Borrower Package checkbox to include the Lender Information pages when generating the URLA 2020 output form for the borrower. This can be selected through loan templates if the lender chooses to always include this form in the package, or it can be done based on business rules, including milestones, if the lender chooses to include this form in some packages but not others (e.g., include the form only in the Closing package, to show the final approved application information that can be viewed with the final Closing Disclosure).

URLA Loan Identifier

Review your policies and work with your investors to determine the appropriate settings for this section and then determine whether you will use business rules or templates to populate the loan identifier on the URLA 2020 output form. You can also manually adjust the options as needed.

To Indicate the Loan Identifier

-

By default, the Encompass loan number is used as the ULRA Loan identifier. If no option is selected (Print ULI on URLA / NULI on URLA (field ID URLA.X119) or Print Both ULI / NULI and Loan # (URLA.X238)), the Encompass loan number will be populated to the URLA Loan Identifier field (field ID URLA.X120) and print on the output form.

-

The Universal Loan Identifier (ULI) (field ID HMDA.X28) is populated to the URLA Loan Identifier field when the Print ULI on URLA / NULI on URLA checkbox is selected.

-

Select the Print Both ULI / NULI and Loan # checkbox to print the Universal Loan Identifier (ULI) on the output form or the Non-Universal Loan Identifier (NULI) for loans reported as partially exempt from HMDA reporting, along with the Encompass loan number in the URLA Loan Identifier field.

If the ULI or loan number changes, or if a change is made to the Print ULI on URLA checkbox, it triggers a change in the loan identifier used on the output form.

Lender Loan Information

The Lender Loan Information section of the input form captures information that is populated to the URLA 2020 output form if the lender opts to include the Lender Loan Information in the borrower package.

Section L1. Property and Loan Information

The information in section L1 on the input form is used to populate the L1. Property and Loan Information section on the URLA 2020 output form. Review the Property and Loan Information section and complete any information that is missing. Additional fields have been included in this section for the purposes of ordering AUS (refinance detail, construction loan details). These fields will work in the same manner as they do in other screens, but are being included on the URLA - Lender page for your convenience.

When the Construction-Conversion/Construction-to-Permanent checkbox (field ID URLA.X133) is selected by default and disabled for editing, the Single-Closing and Two-Closing checkboxes are disabled for editing.

Section L2. Title Information

The information in section L2 on the input form is used to populate the L2. Title Information section on the URLA 2020 output form. Vesting defaults to the identified borrowers on the loan and includes all borrower pairs. The final version of the URLA printed in the closing package will be updated based on the final documented vesting in the Borrower Summary – Vesting input form.

Section L3. Mortgage Loan Information

The information in section L3 on the input form is used to populate the L3. Mortgage Loan Information section on the URLA 2020 output form. Most of the information in Section L3 is populated from other input forms. In the Amortization Type and Loan Features sections, quick entry pop-up windows have been included for convenience in viewing related data for special features. The options for If Adjustable Rate, Negative Amortization, Prepayment Penalty / Prepayment Penalty Term, and Buydown all have quick entry pop-ups. This data can be configured in templates or business rules and will behave the same as the prior version of the application (URLA 2009) if the lender originates loans with these features.

Proposed Monthly Payment for Property

The Proposed Monthly Payment for Property section includes quick entry pop-up windows for generating estimates of the monthly payments for each component of the payment that exist in the current application.

Loan Features

This section provides checkboxes to indicate additional features that will be disclosed. Quick-access pop-up windows have been provided for features that require supporting data. The Payment Deferral for the First Five Years and Affordable Loancheckboxes are used only with AUS and do not affect Encompass calculations or output forms.

Section L4. Qualifying the Borrower

The Due From Borrower(s) section at the top of Section L4 replaces the Details of Transaction section on the URLA 2009 form. With the new URLA, purchase payoffs (payoffs executed as part of a purchase transaction) are recorded on the application. With the URLA 2009 form, the purchase payoffs are not disclosed, which results in a difference between the cash to close amounts on the 1003 and on the RegZ-LE and RegZ-CD except for refinance loans. With the new URLA form, the payoffs not associated with the subject property are now populated in the Qualifying the Borrower section and are factored into the Cash to Close amount for either a refinance of a purchase.

Total Mortgage Loans

The Total Mortgage Loans section includes the Base Loan Amount (excluding financed MI) and the total Applied to Down Payment from Verification of Additional Loans.

The Other New Mortgage Loans on line J includes the total of all the Amount Applied to Down Payment fields (field ID URLARAL0022) entered across all the records in the Verification of Additional Loans input form.

Total Credits

The Seller Credits section includes the Seller credit amounts populated from the itemization input form.

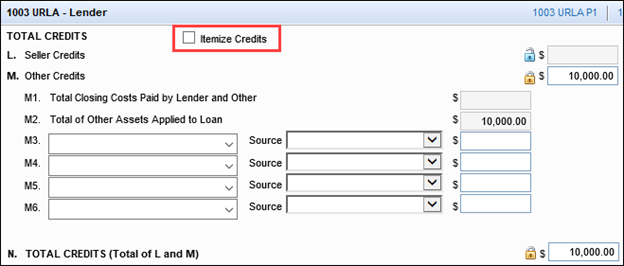

When the Itemize Credits checkbox is cleared, the Other Credits section includes calculated amounts for the Total Closing Costs Paid by Lender and Other, Total of Gifts and Grants, and Total of Other Assets Applied to the Loan (Total Earnest Money Cash Deposits excluding other ‘Other Assets’). Use lines M4-M6 to select any other credits (except for Earnest Money) that are being applied as appropriate for the loan scenario per your company’s credit policy and guidelines.

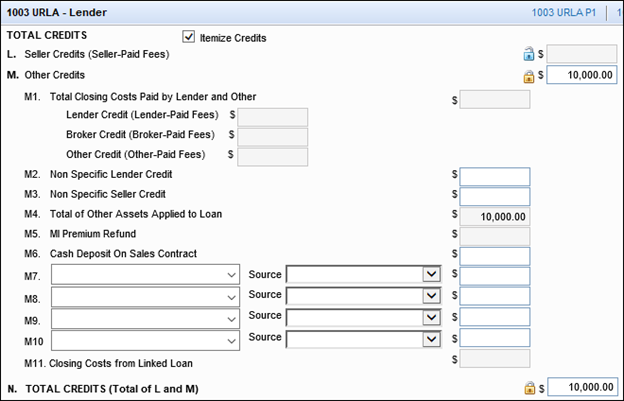

When the Itemize Credits checkbox is selected, rows for itemized entries display in Section M and new calculations are implemented based on the itemized credits.

When the Itemize Credits checkbox is selected, the Qualifying the Borrower section from the URLA 2020 forms replaces the Details of Transaction section on the 2015 Itemization input form.

For a HELOC loan, the following differences display in the Total Mortgage Loans and Total Credits sections:

-

In the Total Mortgage Loans section, on line I, the Loan Amount is replaced with the HELOC Initial Draw at Closing amount. This field is editable. Click the Edit icon to open the Calculate HELOC Amount pop-up window.

-

In the second row on line I, the label for the Loan Amount Excluding Financed Mortgage Insurance is changed to HELOC Total Credit Limit.

-

In the Total Credits section, for loans that are linked via the Piggyback Loan tool, including HELOC loans, line M7 (or M11 when the Itemize Credits checkbox is selected) displays at the bottom of section M:

-

If the currently open loan is linked to a first lien loan, the label for M7 (or M11 when the Itemize Credits checkbox is selected) displays as Closing Costs from Linked 1st and the amount displays in the right column.

-

If the currently open loan is linked to a subordinate lien loan, the label for M7 (or M11 when the Itemize Credits checkbox is selected) displays as Closing Costs from Linked Subordinate and the amount displays in the right column.

-

L5. Homeownership Education and Housing Counseling

Use the Homeownership Education and Housing Counseling section to capture of any homeownership counseling the borrower and co-borrower have already completed. The URLA 2009 form captured fields for the borrower only. The URLA 2020 form captures fields for both the borrower and co-borrower .

Click the Edit icon to open the Home Counseling Providers input form in a pop-up window. The Home Counseling Providers page now returns the HUD Approved Agency number and populates it to the Home Counseling Providers input form and the 1003 URLA – Lender input form. This enables two workflows for populating the data:

-

Launch the Home Counseling Providers input form from the 1003 URLA – Lender input form during an interview to capture the information and look up the HUD Counseling Agency # if the borrower has already received counseling from an approved agency.

-

Automatically update Section L5 by completing the Home Counseling Providers input form when the borrower later completes the education.