1003 URLA Part 1

More Resources on the URLA Support Page

This feature was introduced with Encompass 19.3. (View the release notes)

This topic describes the process for completing Part 1 of the redesigned Uniform Residential Loan Application (URLA) form that is required for all new loan applications in November 2020. For information about the pre-2020 version of the URLA, refer to 1003 Loan Application - Page 1, 1003 Loan Application - Page 2, 1003 Loan Application - Page 3, or 1003 Loan Application - Page 4.

The 1003 URLA Part 1 input form includes a To be completed by Lender section at the top for entering case numbers and selecting the loan identifier that will be populated on the URLA output form. The remainder of the input form consists of Section 1a of the Borrower Information section, which is used to enter personal information about the borrower, including the borrower’s name, marital status, dependents, contact information, addresses, military service, and language preference. Borrower information is entered in two columns, one for the borrower and one for the co-borrower, based on the borrower pair selected.

To Be Completed by Lender

Use the To be completed by the Lender section at the top of the form to enter the Agency Case No. and Lender Case No. for the loan and to configure the loan identifier to use on the output form. The Agency Case No and Lender Loan Number (or ULI) print at the top of the URLA 2020 output forms. The URLA Loan Identifier (field ID URLA.X120) is a read-only field that displays the loan identifier that populates on the URLA 2020 output form. By default, this field is populated with the Encompass Loan Number (field ID 364). Use the checkboxes in the To be completed by the Lender section to configure the loan identifier that is populated on the URLA 2020 output form. Work with your investors to determine which identifier your company wants to use on the output forms.

To Configure the Loan Identifier:

-

Select the Print ULI/NULI on URLA checkbox (field ID URLA.X119) to populate the output form with the universal loan identifier (ULI) (field ID HMDA.X28).

-

Select the Print both ULI/NULI and Loan # checkbox to populate the output form with an identifier that combines the loan number and the universal loan identifier (ULI). If the loan is reported as Partial Exempt from HMDA reporting, the non-universal loan identifier (NULI) replaces the ULI as a component in the combined identifier.

A change made to the ULI or loan number for a loan will trigger a change in the loan identifier used on the output form.

Section 1a. Personal Information

The information entered in Section 1a on the 1003 URLA Part 1 input form is populated to Section 1a on the output form. On the input form, use the fields at the top of the Personal Information section to enter basic information for the selected borrower and/or co-borrower, including each borrower’s name, Social Security Number, date of birth and citizenship status.

Print Additional Borrower URLA

Select the No Co-applicant checkbox at the top of the co-borrower column when there is no co-borrower for the loan.

When a loan has a co-borrower, the borrower and co-borrower might receive borrower information that is formatted differently. This is determined by the selection made for the Use Additional borrower (Joint) Format checkbox.

When the checkbox is cleared:

-

The borrower receives sections 1-8 of the URLA output form containing details of the borrower’s personal income, assets, and liabilities as well as details about joint assets and liabilities shared by both the borrower and co-borrower.

-

The co-borrower receives sections 1-8 of the URLA output form containing details of the co-borrower’s personal income, assets, and liabilities as well as details about joint assets and liabilities shared by both the borrower and co-borrower.

When the checkbox is selected:

-

The borrower receives sections 1-8 of the URLA output form containing details of the borrower’s personal income, assets, and liabilities as well as details about the co-borrower’s assets and liabilities plus joint assets and liabilities shared by both the borrower and co-borrower.

-

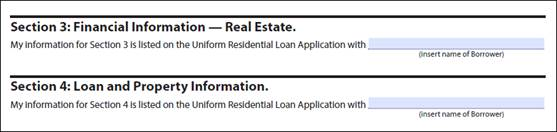

The co-borrower receives sections 1-8 of the URLA output form containing details of the co-borrower’s personal income but does not receive detailed information about any assets and liabilities. Instead, the co-borrower is referred to the borrower’s copy of the output form for detailed information about assets and liabilities in the applicable sections, as shown below.

Alternate Names

Click the Edit icon for one of the Alternate Names fields to open a pop-up window where you can enter alternate names for the borrower and co-borrower that display on the Borrower Information – Vesting input form.

To Add an Alternate Name:

-

Click the Edit icon next to the Alternate Names fields to open the Alternate Names pop-up window for the borrower or co-borrower.

-

Click the Add icon on the upper-right.

-

Type a First name, Middle Name, Last Name, and Suffix if applicable, and then click OK.

Adding one or more items to the pop-up will populate the information into the Alternate Name fields for the borrower and co-borrower on the 1003 URLA Part 1 and the Also Known As field on the Vesting Information section on the Borrower Information – Vesting input form.

Citizenship

Use the Citizenship checkboxes to indicate whether the borrower or co-borrower is a U.S. Citizen, Permanent Resident Alien, or Non-Permanent Resident Alien. Enter the country of citizenship for a non-permanent resident alien.

Type of Credit

In the Type of Credit section, checkboxes are read-only and are selected by default. The individual credit option is selected when there is only one borrower. The joint credit option is selected when there is more than one borrower or more than one borrower pair.

Borrower Count

Two fields are used to capture the borrower count on a loan. The Borrower Count is a calculated field populated with the total number of borrowers across all borrower pairs for the loan file. The Expected Borrower Count field is used with loans that are imported from Encompass Consumer Connect. These applications have a maximum of two borrowers listed on the application, so the loan officer can use the Expected Borrower Count field to enter the total number of borrowers who are expected to be on the loan.

Marital Status

Use the Marital Status section to describe the borrower’s marital or relationship status. When Unmarried is selected in the Marital Status section, the information entered in this section is populated to the Unmarried Addendum output form, which is generated along with the URLA output form.

The information in the addendum is used to determine how state property laws affecting creditworthiness (directly or indirectly) apply to the borrower, including ensuring clear title. For example, the lender can use the Unmarried Addendum when the borrower resides in any state, the District of Columbia, the Commonwealth of Puerto Rico, or any other territory or possession of the United States that recognizes civil unions, domestic partnerships, or registered reciprocal beneficiary relationships or when the subject property is in one of these. Note that while the Unmarried Addendum is available in the Print menu, if Unmarried is not selected in the Marital Status section, the user will receive a blank form when they print it.

To Complete the Marital Status for a Married or Separated Borrower:

-

Select the Married or Separated checkbox for the borrower or co-borrower.

-

Indicate the Number and Age of any dependents in the fields at the bottom of the section.

-

The remaining fields in this section are not editable if the borrower is married or separated.

-

To Complete the Marital Status for an Unmarried Borrower:

-

Select the Unmarried checkbox.

-

Select Yes or No from the dropdown list to indicate whether there is a person who is not the borrower’s legal spouse, but who has real property rights similar to those of a legal spouse.

-

If you select Yes, select an option from the Domestic Relationship Type dropdown list to describe the relationship.

-

If you select Other for the relationship type, enter a description in the Other Domestic Relationship Type field.

-

In the State field, type the two-letter abbreviation for the state or territory where the relationship was formed. Example: MI or OK.

If the Marital Status is changed from Unmarried to Married, Encompass clears all the fields below the Unmarried checkbox and above the two Dependents fields.

Contact Information

Use this section to enter phone numbers and email addresses for the borrower and co-borrower. Clicking the Copy from Borrower button in the Current Address section also copies the borrower contact information to the co-borrower fields in this section. There are three address sections on the 1003 URLA Part 1: Current Address, Former Address, and Mailing Address.

Select the checkbox(es) next to the contact fields to indicate that is the contact's preferred method of contact. Click the Preferred Contact (clock) icon to specify the contact's time zone and preferred day and time of day to be contacted.

-

The Accept Text/SMS checkbox is enabled when the Cell Phone number is populated and disabled when the Cell Phone number is not populated.

![]() Current Address and Former Address

Current Address and Former Address

Military Service

A new Military Service section has been added to capture details of military service for the borrower, co-borrower, or their spouses on the URLA 2020 form. This information will print in Section 1a of the Business Information or Additional Borrower forms.

-

When the No checkbox is selected, the remaining checkboxes in this section are disabled except for the Surviving spouse checkbox.

-

When the Yes checkbox is selected, all four subordinate checkboxes are enabled. More than one of these checkboxes can be selected at the same time.

If the Expiration Date of Service Tour is not known, which is reflected by 88888 on the service member’s pay statement, the expiration date should not be entered.

Language Preference

The Language Preference section is a new section on the URLA 2020 form. User can select one checkbox to indicate the language in which they prefer to do business. If the Other checkbox is selected, the description field is enabled and can be edited. This information will print in Section 1a of the Borrower Information and Additional Borrower Information output forms.

This section is for information purposes. Encompass does not support documents in languages other than English, Fannie Mae has prepared and made available a Spanish translation guide that can be provided to Spanish speaking borrowers to assist them with completing the English version of the URLA. Review your company policies and determine how your company will deal with this information regarding communications and processes with customers with limited English proficiency who request a specific language other than English.